What is a Credit Score & How is it Calculated in Canada?

6 mins read

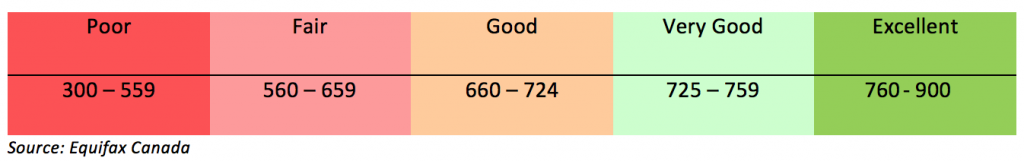

Credit Score Ranges in Canada

Your credit score is not a fixed number. It can vary over time depending on your current situation and on the information found on your credit report when it is pulled.Your credit score is not a fixed number. It can vary over time depending on your current situation and on the information found on your credit report when it is pulled.

Who Calculates Your Credit Score?

What is on my Credit Report?

Your credit information is summarized in a file known as your credit report. Although each credit bureau formats and reports its data differently, all credit reports contain the same categories of information. These categories include:

- Your personal information such as your name, date of birth, social insurance number, address, phone number, and employer.

- Your different credit accounts:

- revolving – which are accounts that generally include a credit limit and require a monthly minimum payment, such as credit cards and lines of credit.

- Mortgage – which is your account when you take out a loan to buy a house.

- Installments – which are loans that require monthly payments until the loan is paid off, such as car loans or student loans.

- Others – which are any other account such as phone bill, child support obligations, rent, etc.

- Your personal information such as your name, date of birth, social insurance number, address, phone number, and employer.

- Public records and collections such as bankruptcies, consumer proposals, collections, and judgements.

How is my Credit Score Calculated?

There are many ways of calculating your credit score, but the main method and score used by the credit bureaus is the Fico score. This is the score most lenders consider when making their decisions about credit approvals, terms and interest rates, so that’s the score we will focus on. The main criteria used when calculating your Fico score are as follows:

There are many ways of calculating your credit score, but the main method and score used by the credit bureaus is the Fico score. This is the score most lenders consider when making their decisions about credit approvals, terms and interest rates, so that’s the score we will focus on. The main criteria used when calculating your Fico score are as follows:

- Payment history (Weight ~ 35%)

Your payment history has the biggest weight in your credit score calculations. It includes information about how you repay the debt you owe. This criterion includes all your on-time payments, late or missed payments, public records and collection items. They look at the number of months your payments were late, the amount of the debt, and how often and how recently you have had late payments. This will be shown for all your tradelines. Negative items such as late payments, bankruptcies, collections and others generally stay on your credit report for approximately seven years.

Tip: Always make your payments on time.

- Total Debt (Weight ~ 30%)

This is the second most impactful criterion on your credit score. Here, they analyze how much of the total available credit on your revolving credit is being utilized. For example, having a credit card with a credit limit of $1000 with a balance of $800 will have an 80% credit utilization. It also considers how much is still owed on your installment accounts in comparison with their original amount.

Tip: Keep your credit utilization at around 30% or lower.

- Credit history Length (Weight ~ 15%)

This takes into account how long your credit profile and each of your tradelines have been open. The longer your credit history, the better, because it shows creditors how over time you’ve been able to manage your different debts.

Tip: Start building credit as soon as possible.

- Credit Mix (Weight ~ 10%)

This refers to the different types of credit accounts that make up your credit report including credit cards, student loans, car loans, mortgages, and more. This indicates to lenders that you can manage several types of debts over time.

Tip: Get a healthy credit mix of at least two different credit accounts.

- New Credit Accounts (Weight ~ 10%)

This criterion looks at the number of new credit or new inquiries you have on your credit report. Having many recent inquiries and new credit sends a message to lenders that you might be in financial hardship, in search of liquidity and therefore meaning you might default on your payments. There are two types of credit inquiries. A “hard inquiry” has an impact on the calculation of your credit score. These are the inquiries made by creditors when you apply for a credit product such as credit cards, mortgages, car loans, etc. A “soft inquiry” does not impact your credit score. These inquiries provide less information than a hard credit check and are typically performed by an employer, a lender who wants to prequalify you for a product, or even when you access your credit report yourself through the credit bureaus.

Tip: Only apply for the credit you need.

All these criteria are then calculated and added up, which gives your final credit score. It is important to mention that lenders also consider your income and your assets when assessing your credit profile.

What are my rights?

You are responsible for being aware of your rights and the duties of lenders and creditors. Some laws help protect consumers in the credit industry. In Canada, provincial and federal laws outline these rights and duties. The information in your credit report should be accurate, fair and private. It is your responsibility to know what is on your credit report and if there are any errors, for you to have them corrected. Here are some of the general key points about your rights and creditor’s duties:

- You have the right to have a free copy of your credit report. You can do so by going directly to Equifax and/or Transunion websites. This will not impact your credit score as it is a soft inquiry.

- You have the right to dispute errors on your credit report. If you find out that there is inaccurate information, you can contact the credit bureau or the organization that reported the incorrect information to the credit bureau. Your dispute must be investigated, and the credit bureau must correct all incorrect information.

- Creditors or any party wanting to access your credit report must have your consent before doing so unless specified otherwise by law such as a court order.

Summary

Credit is an important aspect of our life as it follows us everywhere. It will determine the financial opportunities you will have in the future, so, have a good understanding of how your score is calculated and maintain a healthy credit score. Get your free credit report from the credit bureaus and keep good financial habits. A good way to start building credit without taking any additional debt is through the soon-to-come opportunity offered by Kredax, enabling renters to have the rent payments they already make count towards improving their credit scores. Join the waitlist and get notified when this opportunity is out!